Trying to Save Money on a Loan Can Be Costly

Our client found the perfect home for an incredible value. We negotiated the sale and a fabulous offer was secured for our buyer. He had instant equity upon closing. But the sale never closed.

We'd recommended lenders to him, but he chose to use another lender. Why? Because he would save $1000 in closing costs.

Unfortunately, this lender rarely spoke to the buyer and would not return our phone calls. Without this communication, it was clear what was happening. Nothing. After two weeks, our client got nervous and decided to switch to a recommended lender. This lender was getting the job done, but having lost the first two weeks of the transaction time, this lender asked for a week's extension.

The seller refused to extend the closing date to accommodate the extra needed time for financing. He decided he'd sold his home for too low of a price and he could get more money for his home. He wanted to put his home back on the market. Our buyer lost this fabulous home and the equity he would've had if he'd been able to close the sale. The equity he lost was worth far more than the $1000 he could have saved on the loan.

It's always important to work with a lender who'll get the job done for you. It's even more critical in our fast paced market. Sellers may not be inclined to let you change lenders or extend the closing time. If you change lenders after the offer has been accepted, the seller has to agree in writing to the lender change. You, as the buyer, can't just up and change lenders without the seller's permission, as you could be in default on the contract and lose your earnest money.* What if you need an extension? The seller also has to agree to any extension to the closing date. If the seller doesn't agree in writing to an extension, then the offer dies on the original closing date and the seller is free to sell the home to another buyer.

Keep in mind how important it is to use a lender with fair pricing, but also a lender who has a proven track record to get the job done. Get referrals from your Realtor, friends or family. Choose a known quanity to do the job. You could lose a lot more than $1000, you could lose the home you want to buy.

*As always, with any legal issues, it's important to seek the appropriate legal advice from an attorney.

Buyers, Interest Rates Are Hot!

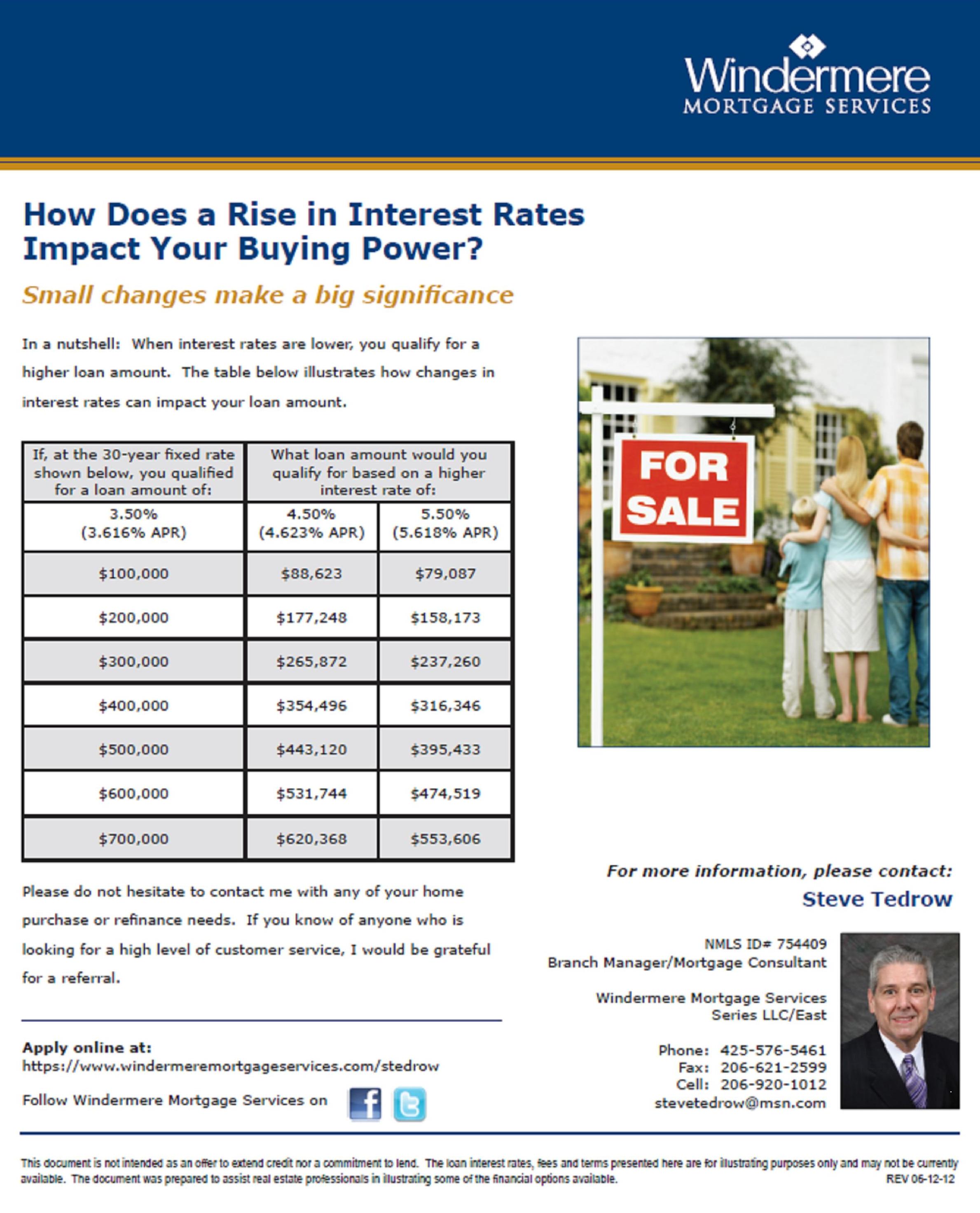

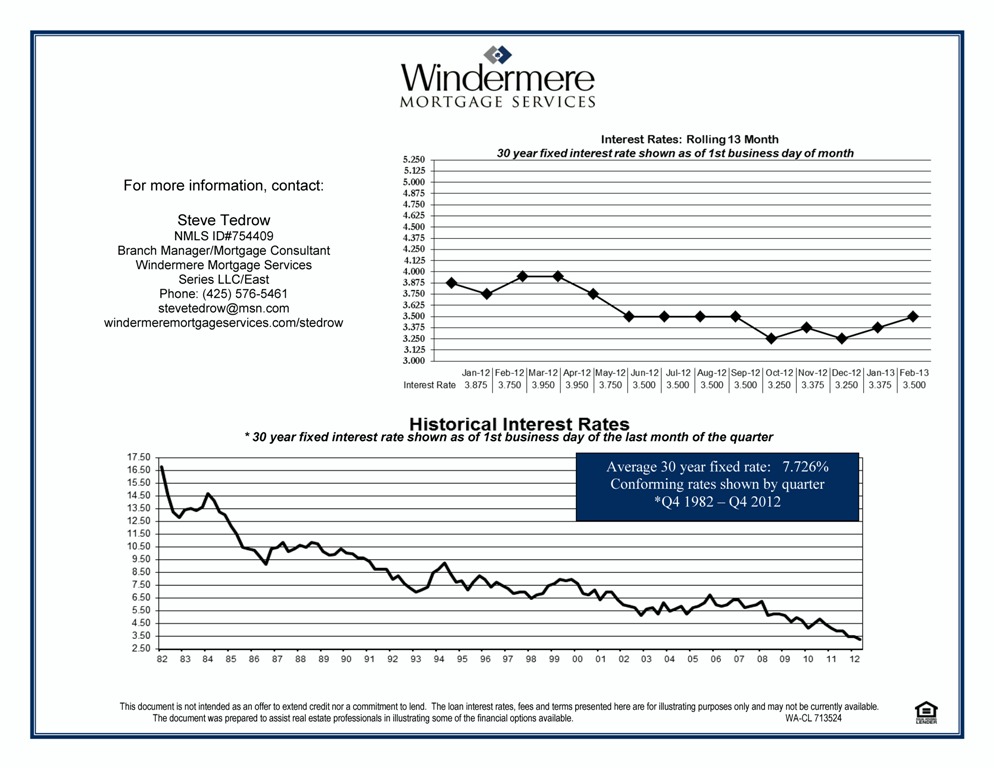

After I wrote my last post on the state of the Seattle eastside real estate market, I felt it important to remind buyers that even though it's a seller's market, Interest rates are hot! Interest rates are on your side. Prices are starting to increase, while interest rates are still on the incredibly low side. It's a recipe that calls for action, for not sitting on the fence and for making a move. Literally.

After I wrote my last post on the state of the Seattle eastside real estate market, I felt it important to remind buyers that even though it's a seller's market, Interest rates are hot! Interest rates are on your side. Prices are starting to increase, while interest rates are still on the incredibly low side. It's a recipe that calls for action, for not sitting on the fence and for making a move. Literally.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link