How Badly is Seattle's Eastside Real Estate Affected by Distressed Sales

“Distressed Homes Sales Dragging Prices Down” screamed the print version of The Seattle Times, while the online version shouted “Median Home Price in King County Drops in February, Dragged Down by Bank Repos.

Pretty scary headlines. Scary headlines certainly attract readers. Distressed home sales, bank repos and short sales, are out there and affecting home values, but in varying degrees depending on which neighborhood is being discussed. If you read further down in the article:

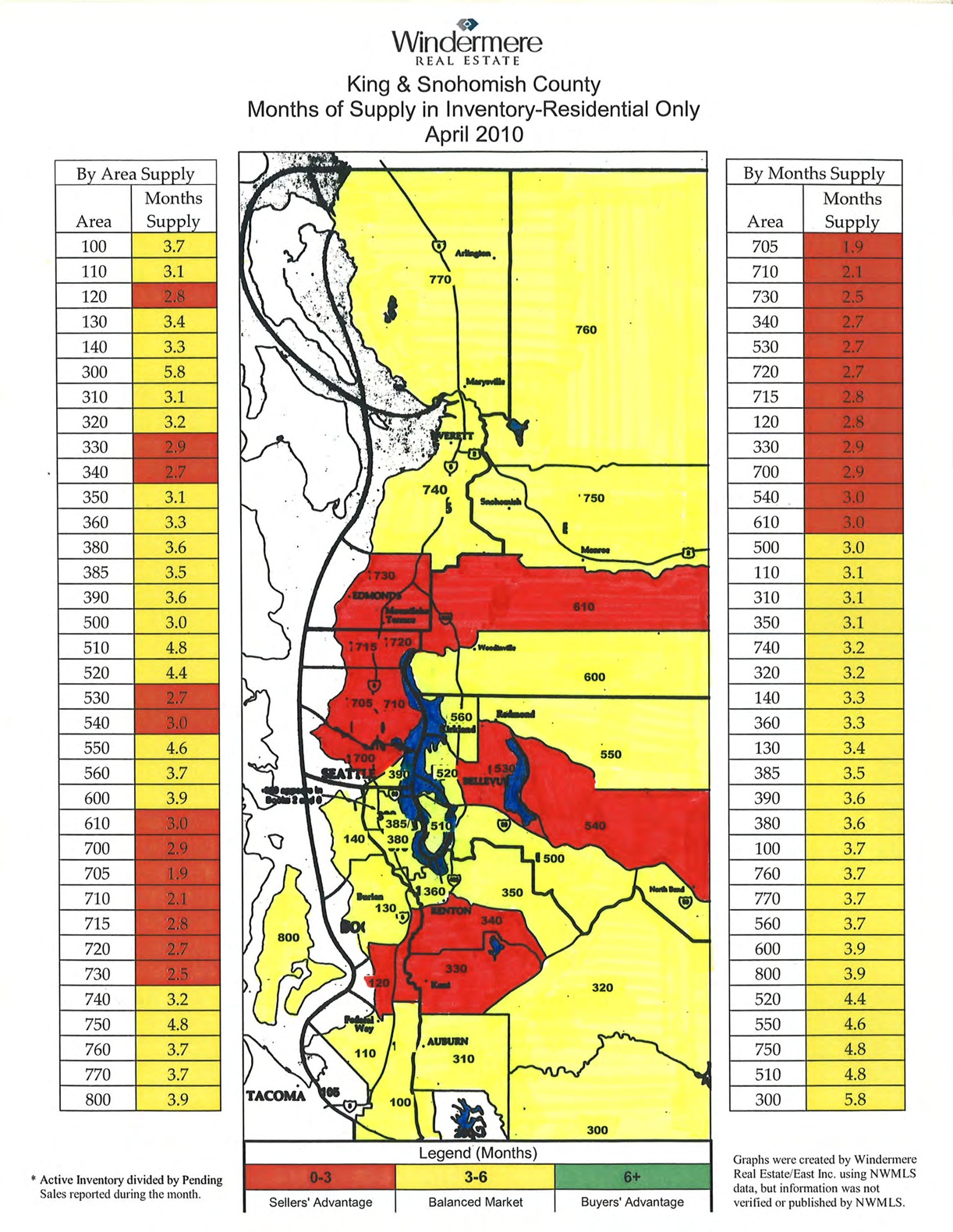

The percentage of King County single-family homes that fit the “distressed” category in February varied widely by area, according to Windermere’s analysis.

By lumping all of King County together, it gives an inaccurate picture of Seattle real estate. Seattle real estate is far more localized. The neighborhoods of Queen Anne and Capitol Hill are usually the strongest performing areas, while the eastside suburbs of Bellevue, Redmond, Kirkland, and others are doing better than most of King County. The suburbs of Mercer Island and Medina have few distressed properties for sale.

The chart below gives a picture of the 2010 distressed property sales for all the counties around Seattle. My focus is on Seattle’s eastside neighborhoods, since it’s the market where I work. The eastside data is broken out from the rest of King County, because it’s usually different than the rest of the county. The pattern for distressed sales activity can be seen through 2010. The eastside had less distressed properties for sale than the rest of King County. I expect a similar pattern to continue in 2011, although the numbers may be different. When the 1st quarter numbers are released, I’ll report those numbers.

Irrespective of the distressed sales issue, homes are selling well in some areas. Prices are less than they were, but there are fewer homes for sale in many neighborhoods. So the old law of supply and demand is working in these neighborhoods. Near Microsoft in Redmond, there were three home sales that closed this past week. All the homes sold in less than 8 days. One was for full price, another for slightly over, and one sold for about 2% less than the asking price. Neighborhoods in Kirkland have a lot less homes for sale than is typical.

Distressed home sales are a part of the picture of Seattle eastside real estate, but they are not the complete picture. Too bad the screaming headlines didn’t balance more of the good news with the bad.

What is happening in your neighborhood? Are homes selling? Are there a lot of distressed sales?

Seattle Economist's Predictions for the 2011 Real Estate Market, Part II

Matthew Gardner, of Gardner Economics, spoke at our annual Windermere Real Estate/East, Inc kick-off meeting today. Mr. Gardner shared his thoughts about the local economy and Seattle real estate. Here are some of the highlights:

- Seattle will recover more quickly than other parts of the west.

- Growth will be slow and from the center, Seattle, out to the suburbs.

- The private sector has increased job growth in the last 4-5 months and will continue to do so.

- There will be more price corrections for those hi-rise condos that have not sold both in Seattle and Bellevue.

- Buyers are still looking for good deals and feel uncertainty remains.

- Prices are stable and, hopefully, will stay that way this year.

- Banks are not releasing all of the bank owned homes to sell. The banks would go bankrupt if they flooded the market with these homes, causing prices to drop.

- Mortgage rates will increase: over 5% this year, 6% in 2012, and 7% by 2014.

Here’s a few of Mr. Gardner’s thoughts for 2011 from the first of the year.

What do you think? Is this what you see happening in the area and with real estate?

Seattle Eastside Real Estate: The Glass is Half Full, Not Half Empty

It’s time to accept the reality of the market in Seattle and on Seattle’s eastside. More than likely, it’s going to be the way it is for a few more years, with single digit appreciation after that.

It’s a more realistic market. It doesn’t mean it’s bad. It’s still challenging to sell a home, but it’s not impossible. Homes are selling everyday. There have been many successful sales and there will continue to be successful real estate sales in 2011. On Seattle’s eastside, 7310 homes sold last year. Short sales and foreclosures will still happen. Which, unfortunately, means there will be people who are suffering through these tougher, more realistic times. But the majority of sales on the eastside are not short or distressed sales.

If you are thinking of selling your home, it won’t happen overnight, but it can, and does, happen.

- 2010: 9,594 homes and condos were pending (received an offer from a buyer). There were 7310 firm sales.

- 2009: 8,842 homes were pending.

- 2008: 7419 homes were pending.

Right now in the Seattle area real estate market, most homes are selling in 3-6 months. This is the now the “normal” market time to sell a home. Some homes will sell very quickly depending on the local competition and the price and condition of the home, others will languish and maybe never sell. This will be the typical pattern we’ll see in Seattle area real estate sales for the near future.

Don’t put your home on the market unless you’re clear on the pricing, clear on what the market will bear. This is not a market where you can “try” a price and then come down. If you beat the competition to start, you’ll probably make more money in the long run. Too often, sellers have “tried” a higher price and ended up selling their home for far less.

Is it moving, making a lifestyle change, or the money that’s more important to you right now? If it’s the move that’s more important because you need more space, downsizing, relocating, etc., then plan to move and do it right. Get your home gleaming and ready for the market with a value added sticker price. Your home will need to outshine the competition with a pristine look and a “beat the competition” price. If you price your home right where all your competition is, your home may not stand out.

If more money than the current market will bear is more important, then maybe this isn’t the right time to sell. However, plan on staying put for 5 or even 7 years to realize some significant appreciation in your home’s value. But remember, if there’s only 3% appreciation over 5 years, that’s 15% more. Let’s say you have a home that is worth $500,000 in this market, in 5 years at 3% appreciation, it will be worth $515,000. A 5% increase is $25,000 to $525,000. The increase is nothing to sneeze at, but with 5-7 more years of wear and tear, there’s something that needs to be done with most every house. Any future appreciation should factor in some costs for maintenance and updating.

For those buying, home ownership has gone back to what it always has been, shelter, a place to hang your hat that you enjoy. It’s a lifestyle choice, not a banking machine or something where you can make a “killing.” If you decide to buy, and some of you won’t, then evaluate your home for how it fits your lifestyle. Pick a place to live that matches your wallet and that you enjoy. Pick a place with good access to amenities: schools, shopping, parks, economic centers and easy access to commuting services. When you sell your home in the future, the home will be in a better position, literally and figuratively, to capture any appreciation. The homes located close to conveniences will become increasingly more desirable in this decade.

The glass is “half full” in Seattle area real estate. The media will continue to talk about the “bad” real estate market, but the fact is, the people who need or want to move are still going forward with their plans. Home sellers will not see the appreciation of the past, but home buyers should be able to purchase a good value and a great home. Remember if you’re a seller who’ll be buying another home, you’ll have a great chance of making a great deal on your home purchase.

It wasn’t “perfect’ for buyers back when we all thought the real estate market was great. Many of today’s sellers need to think back to when they bought their home. Buyers often competed for the same home with other buyers and paid full or over full price. Now it’s not perfect for sellers.

Sellers have to be ready to meet the market. Buyers will be looking for the best value out there. That won’t change any time soon. This is our new “normal” market.

This is the “State of Real Estate.” Our glass is “half full” rather than “half empty.” We’re still doing better than most areas here in the Seattle area.

Seattle Economist Makes Real Estate Predictions

Thinking about the economy in 2011? Who isn’t these days?

Local economist, Matthew Gardner presented his predictions for next year’s economy and the real estate market.

(photo: Andrew@cubagallery)

Here are a few of his predictions for 2011:

Economic growth will remain slow, particularly for the first half of the year.

An “easing” in the economy should been seen as the year progresses, helping to restore some consumer confidence.

The unemployment rate will drop some, but improvement will be slow.

A 5% decline in home prices across U.S.

Inflation will be minimal, benefiting home buyers.

Interest rates should go higher, but still remain on the lower side.

What do you see happening in your area?

Hope your 2011 will be looking up!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link