The Seattle-Eastside Condo Market is Amazing!

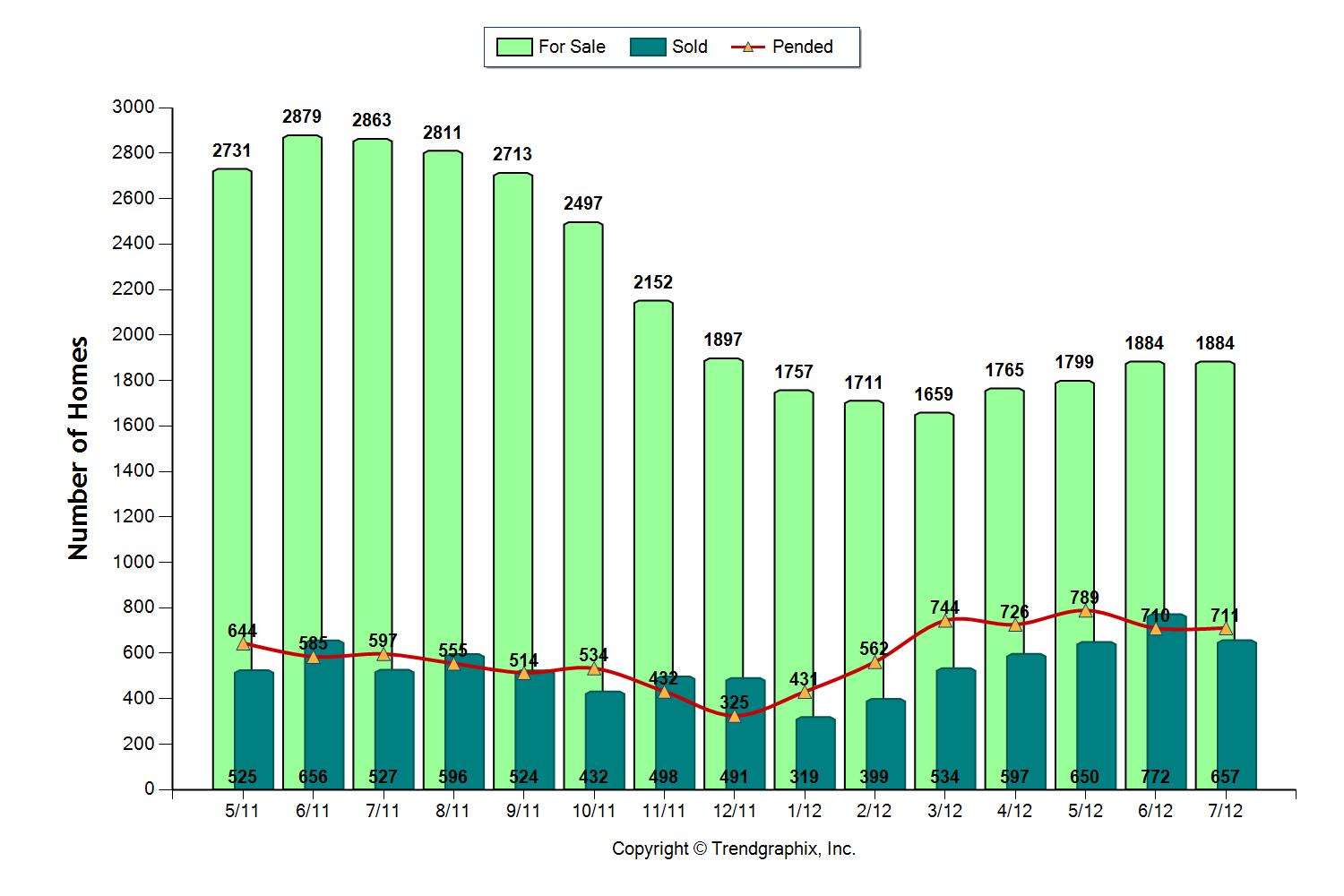

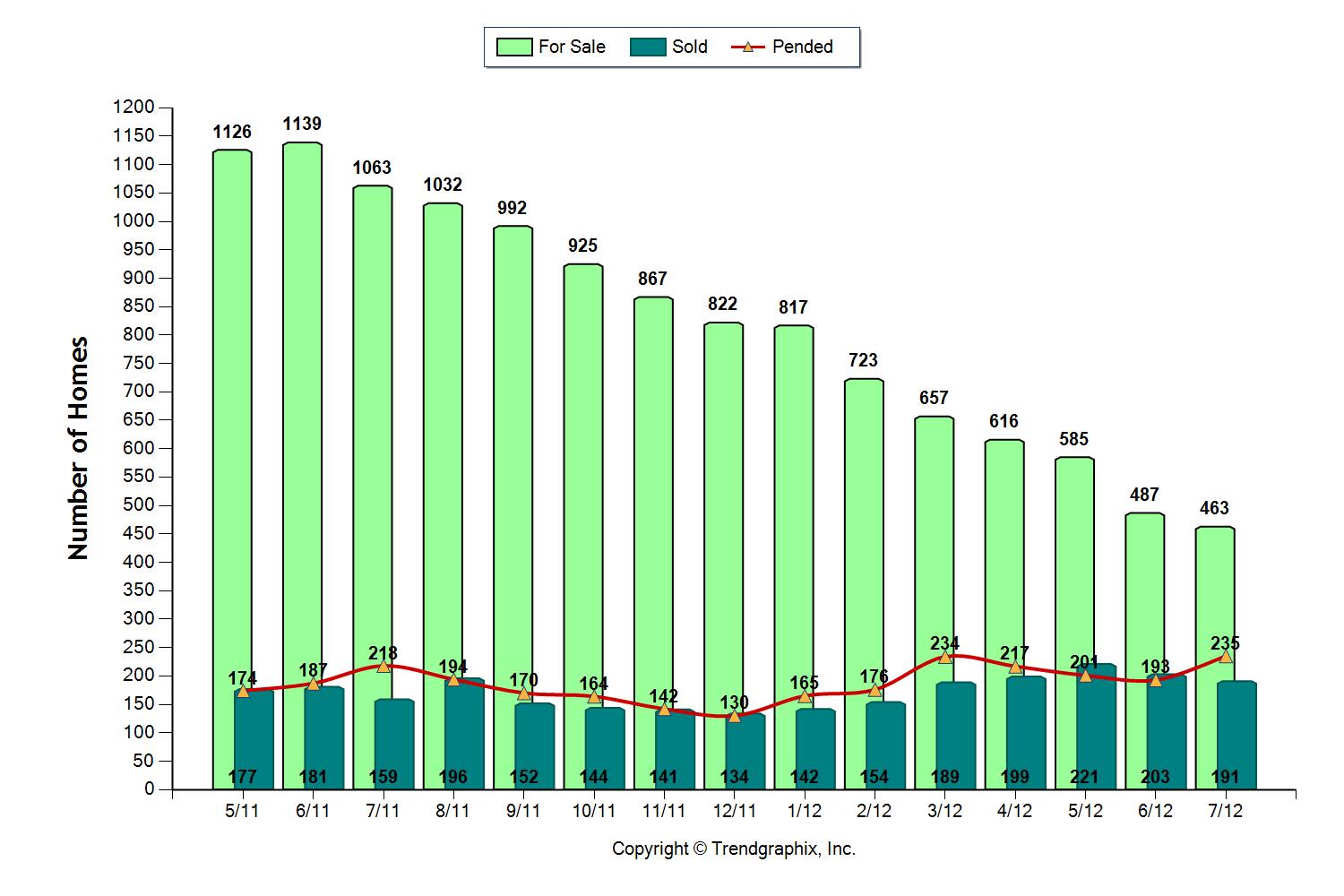

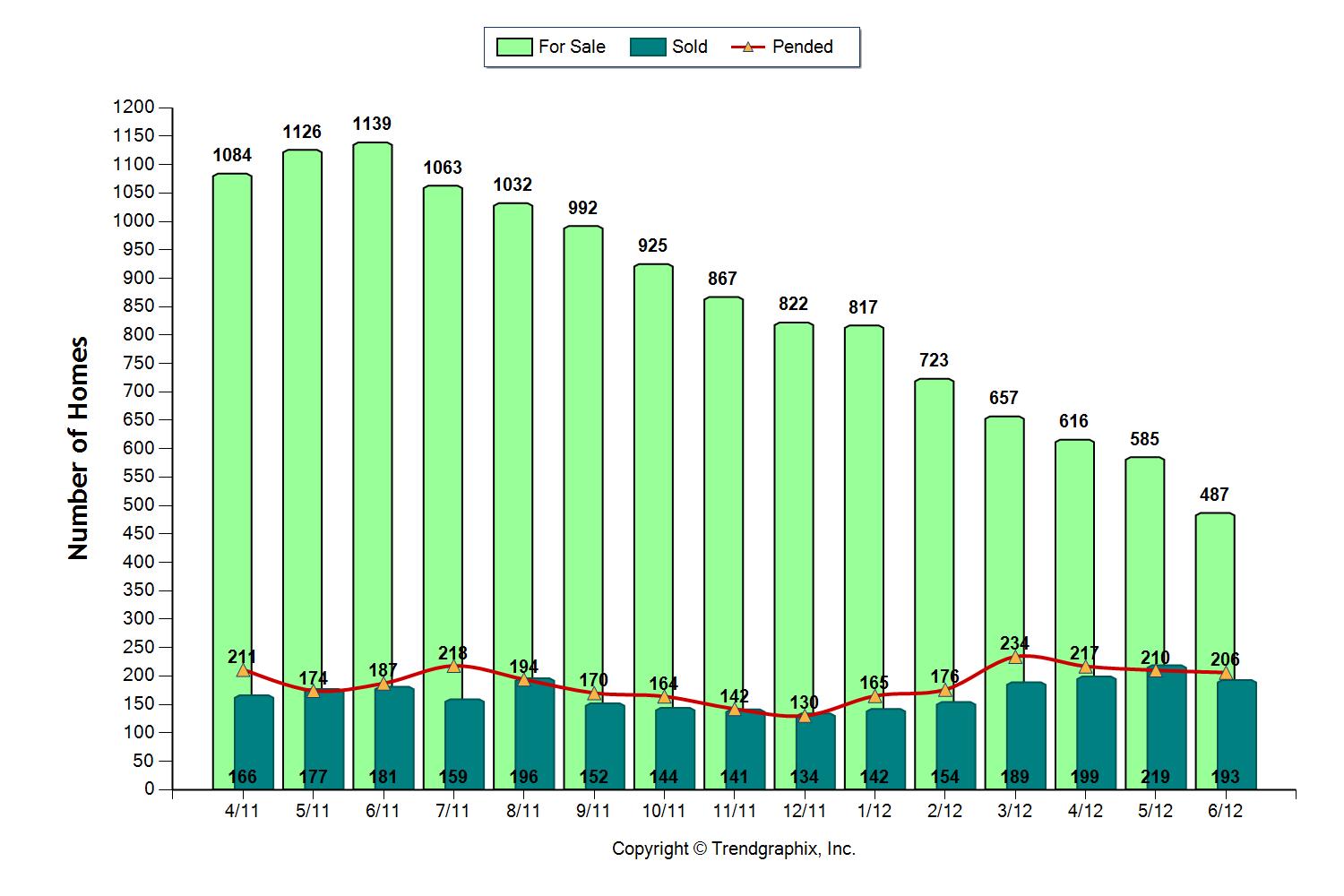

Our amazing Seattle-Eastside real estate continues! How low can the supply of eastside condos go? In July there were only 463 condos for sale all over the Eastside, less than half the number of condos for sale in July of 2011! The supply is low and the prices have dropped considerably over the last few years as evidenced by the chart below. These market conditions bode well for buyers. Prices are at the bottom and with the low supply, they should begin rising. Unfortunately for the sellers who bought from 2007 on, it's still a tough market as pricing is well below the high experienced during that time.

Not only was the supply at the lowest I can remember, the number of sales were at the high so far for the year. There were 463 condos for sale and 236 of them sold! I've been in real estate on Seattle's eastside for 25 years and I've never seen anything like the lack of supply in the market we're experiencing now. In previous reports I mentioned if the supply of condos stayed on the low side, to expect the positive market to continue in Bellevue, Kirkland, Redmond, and the other cities east of Seattle. This was how the real estate market performed in July.

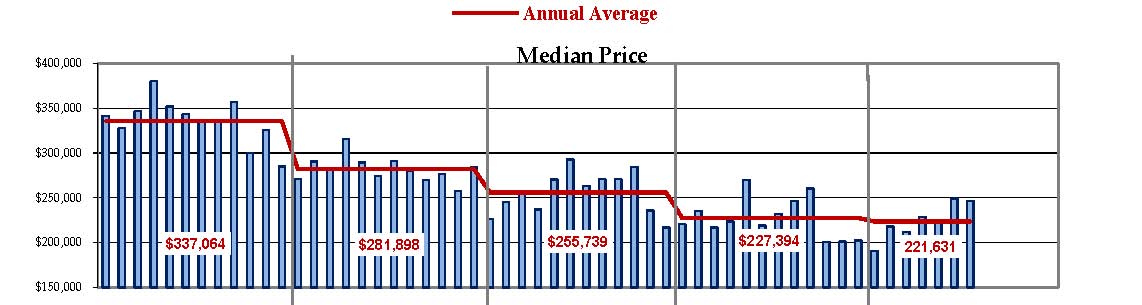

The chart beow shows the trend in pricing from 2008-2012 for condo sales on the eastside. Each blue bar represents a month during the years that are represented below. The red line that is drawn across each year shows where the median point is in pricing for the year.In 2008, the median pricing for condo sales on the eastside was $337,064. So far this year, the median pricing for sales is at $221,631. If you look at 2012, pricing has jumped up for the last two months, but on average, it's still lower than previous years.

Time on the market has also dropped to an average of 90 days to sell vs.109 days in June of 2011.

If you have any questions about the condo market, please feel free to contact us.

Did July’s Real Estate Prices Really Go Up By 7% on Seattle’s Eastside?

The Seattle media had screaming headlines recently about the 7% increase in King County real estate prices this July when compared to last July. Were the newspaper headlines right? As I've mentioned before, yes and no.

What did the media get correct when they said prices had gone up from July, 2011 to 2012?

They were only comparing the sales from July, 2011 to July, 2012. The median price was based on the sales that happened only in those two months. This could mean more expensive homes sold in 2012 than in 2011 or it could mean prices were higher. It is hard to know based on this one month. A snapshot of one month's real estate sales does not make a trend. It only shows how sales compared for those two months, so the Seattle Times was correct in stating the prices had gone up in from July, 2011 to 2012 by 7%. However, this is not the full picture.

How can you more accurately tell if real estate prices are going up, down or staying the same?

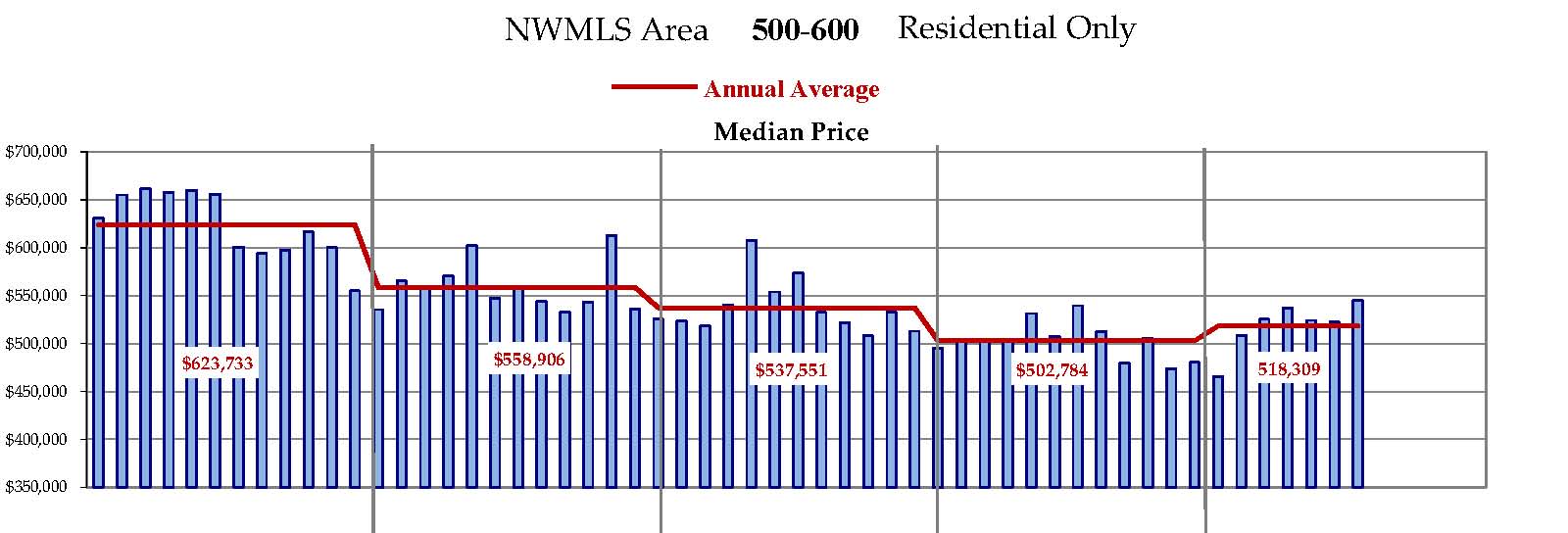

It's important to look at a pattern for a period of time, such as you can see in the chart above.

What does the chart show?

The chart is a compilation of all the home sales on the eastside, including such cities as Bellevue, Kirkland, Redmond, Woodinville, Sammamish, Issaquah and more. The NWMLS (Northwest Multiple Listing Areas) for these eastside cities are represented by area numbers 500-600 displayed at the top of the chart.

Windermere Real Estate compiled the data from each month and developed this chart to show median pricing for the past 5 years. If you look at the bottom of the chart, you'll see the years 2008-2012. Each blue bar above the years represents a month during each of the years. The red line going across the chart shows the median price point for each year. It was highest in 2008, when the median pricing for the year stood at $623,733 and had gone down consistently through the end of 2011, when the median pricing for the eastside stood at $502,784.

This year the chart shows the median pricing is creeping up, but here on the eastside and in other parts of King County, it's not up by 7%, but by about 3% so far for the year. The median for this year is at $518,309.

This is a much more accurate picture of real estate values on the eastside, not just a measure of one month's sales. Are you seeing similar trends in your area?

If you have questions about the value of your home, please feel free to contact us and we can take a closer look at the data for your home.

Were June Condo Sales on Seattle’s Eastside Still Hot?

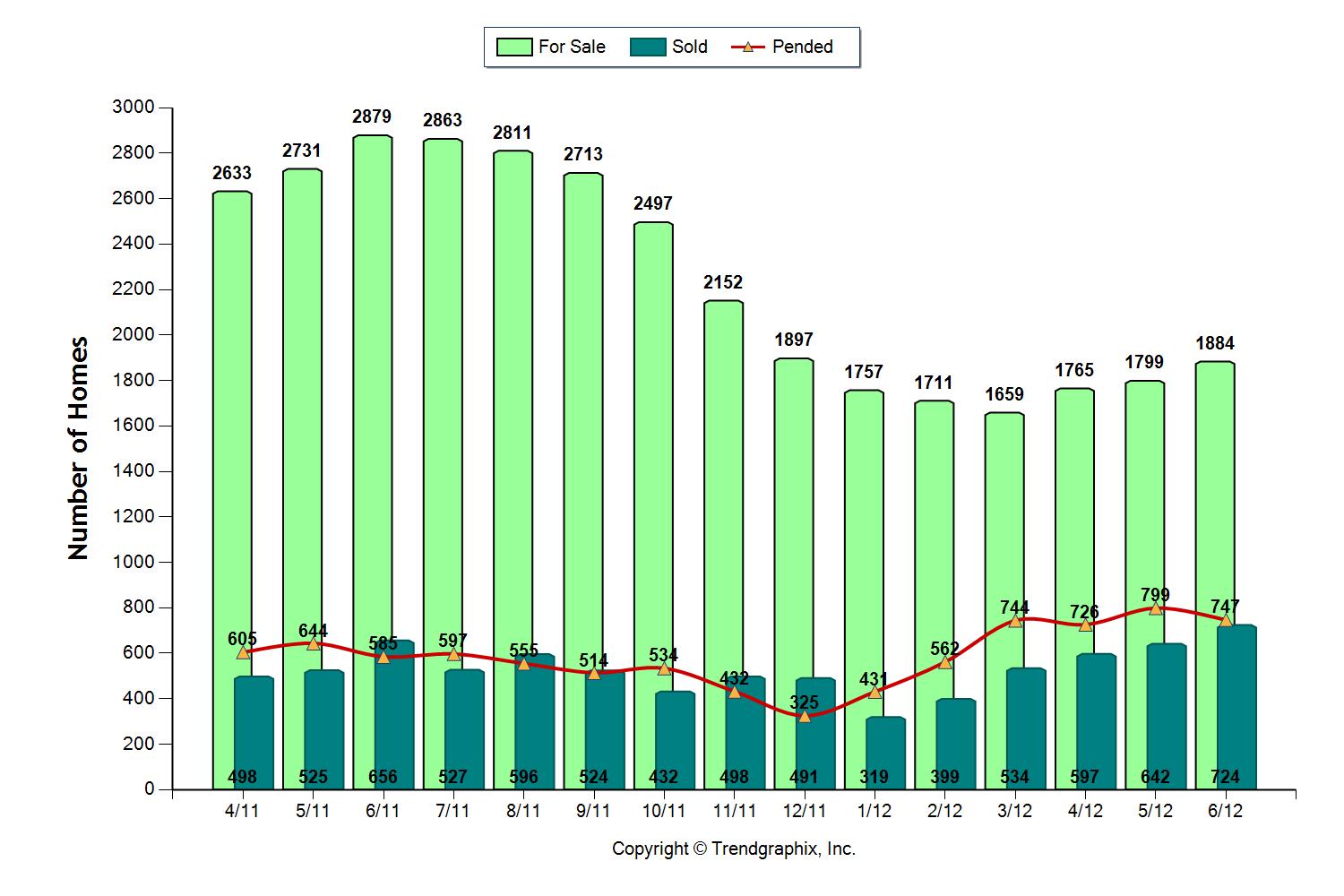

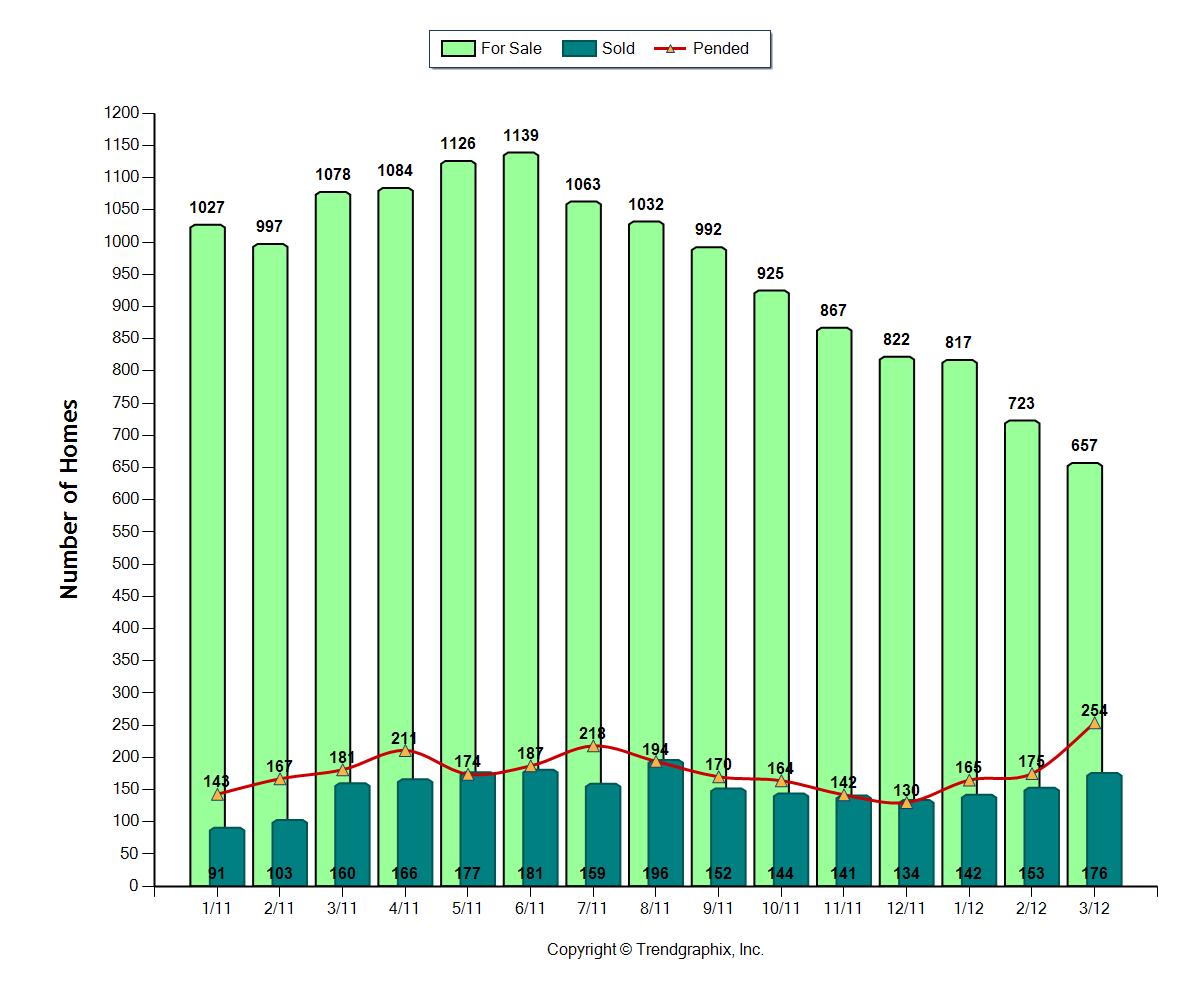

What an amazing condo market on Seattle's Eastside! Since June of 2011, the number of condos for sale has continued to drop, and drop by alot. Last June there were 1139 condos for sale and this June there are less than 500! What a huge difference!

Not only are there fewer condos for sale, but the sales have been very strong, especially since February. The condo market has been even stronger over the past two months. Approximately 42% of the available condos sold in June. If the supply of condos stays on the low side, expect this positive market to continue in Bellevue, Kirkland, Redmond, and the other cities east of Seattle.

Median pricing was $235,000 this past month, whereas last year the median pricing for the month stood at $250,000. Don't worry too much about pricing for one month's worth of sales. As we always say, you must follow the trend over a period of months to measure any true increases or decreases in value. One month's real estate prices are only a reflection of the sales that happened that particular month.

Time on the market has also dropped to an average of 90 days to sell vs. 118 days in June of 2011.

So get our there and find a great home, but do your homework before getting in the car to look at properties. Check out the commute, the neighborhood, schools and anything else that is of importance to you before you start looking for a home. If you do that, you can target the right location to look for a home. You can then look for a home that works for you in a the right location.

Remember location, location, location is the primary rule of real estate. In today's world, location can mean many different things to people based on job location, commutes, and area amenities. Determine what it means to you and then go for the condos in that particular location.

If you have any questions about the condo market, please feel free to contact us.

How Do You Go From For Sale To Sold on Seattle’s Eastside?

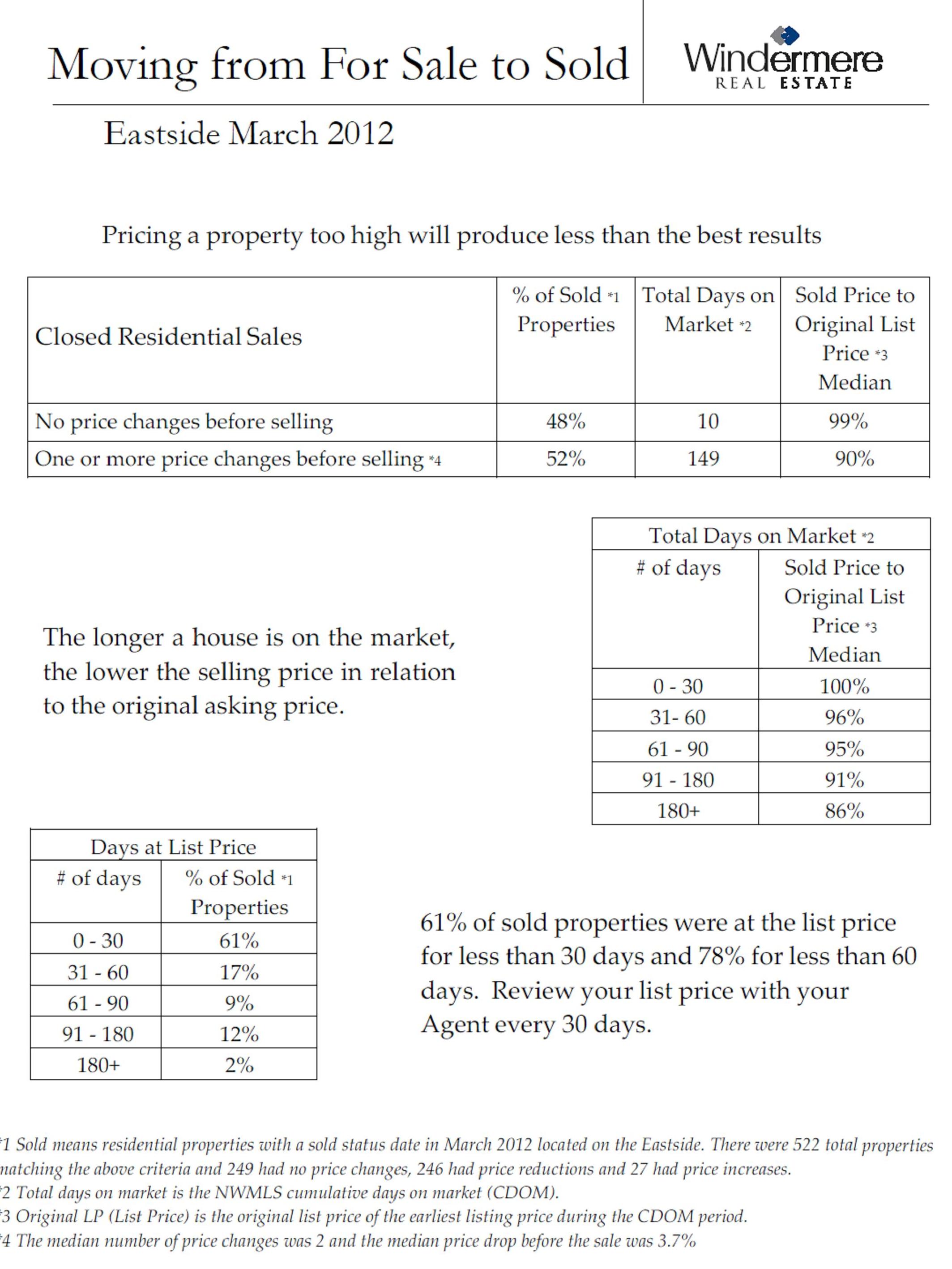

How do you get from “for sale” to “sold?” It’s the price! Even though the real estate market in Bellevue, Kirkland, Redmond and other eastside cities is red hot, the price is still critical to getting a “sold” sign posted on the “for sale’ sign in your front yard.

Almost half, 48%, of the homes for sale between September, 2011 and March, 2012 sold in 10 days or less! With these homes only on the market for fewer than 10 days, the homeowners and their Realtors did everything right. The homes had to be priced right, show well, have fabulous photos and great marketing or the homes would not have sold.

Seeing these incredible numbers should help blow several common misconceptions out of the water:

1. Should you leave negotiating room when you set the price for your home? NO. Some homeowners think they should leave bargaining room. This, however, will send that homeowner down a path toward a longer market time and a lower selling price. Look again at the top line of the first chart. Almost half the homes sold within 99% of asking price and in under 10 days. With sales prices coming in at 99% of the asking price, there was little bargaining in the final sales price.

2. What if you want to price your home high because you’re in no rush to sell? A homeowner who overprices a home will shoot themselves in the foot. Let’s say a buyer is out searching to buy a home and sees 5 homes. The buyer will compare each one’s price, location, and features. They don’t compare whether a seller is a rush to sell or has all the time in the world. The buyer won’t know that. The buyer will only know that when comparing the homes, the overpriced home will stand out. Most buyers don’t bother to make an offer because there are 4 other homes that are more attractive and priced right. There’s no need to waste time pursuing an overpriced home because, even though the supply is low, there are other homes on the market. If today’s market pricing doesn’t meet a homeowner’s needs, then don’t put the home on the market.

3. Were these homes underpriced, because they sold so quickly? No. In today’s real estate market, we’re dealing with very savvy buyers. They know the market and they know pricing. They know when they see a home that’s well priced and they’ll pay for it. The buyers don’t have time to waste. The good homes are going fast. Secondly, does anyone really think that half of the homes that sold in the last 6 months were underpriced? I don’t think so!

The other 52% of the homes took 149 days to sell and sold with an average of a 10% discount. If you look at the second chart, you can see for every 30 day period a home is on the market, the selling price drops. Homes that were on market for a long time were the homes in which sellers could bargain with the buyers, but it usually meant the price dropped. Buyers think a home is overpriced or there’s something wrong with it if the house is on the market for more than a month in this market.

If you decide to sell your home, you’ll need to decide in which half of the market you’d like to be. Do you want to be in the market in which your home could sell quickly and for a good price or do you want to test the waters, take your time, and more than likely sell for less? It’s your decision.

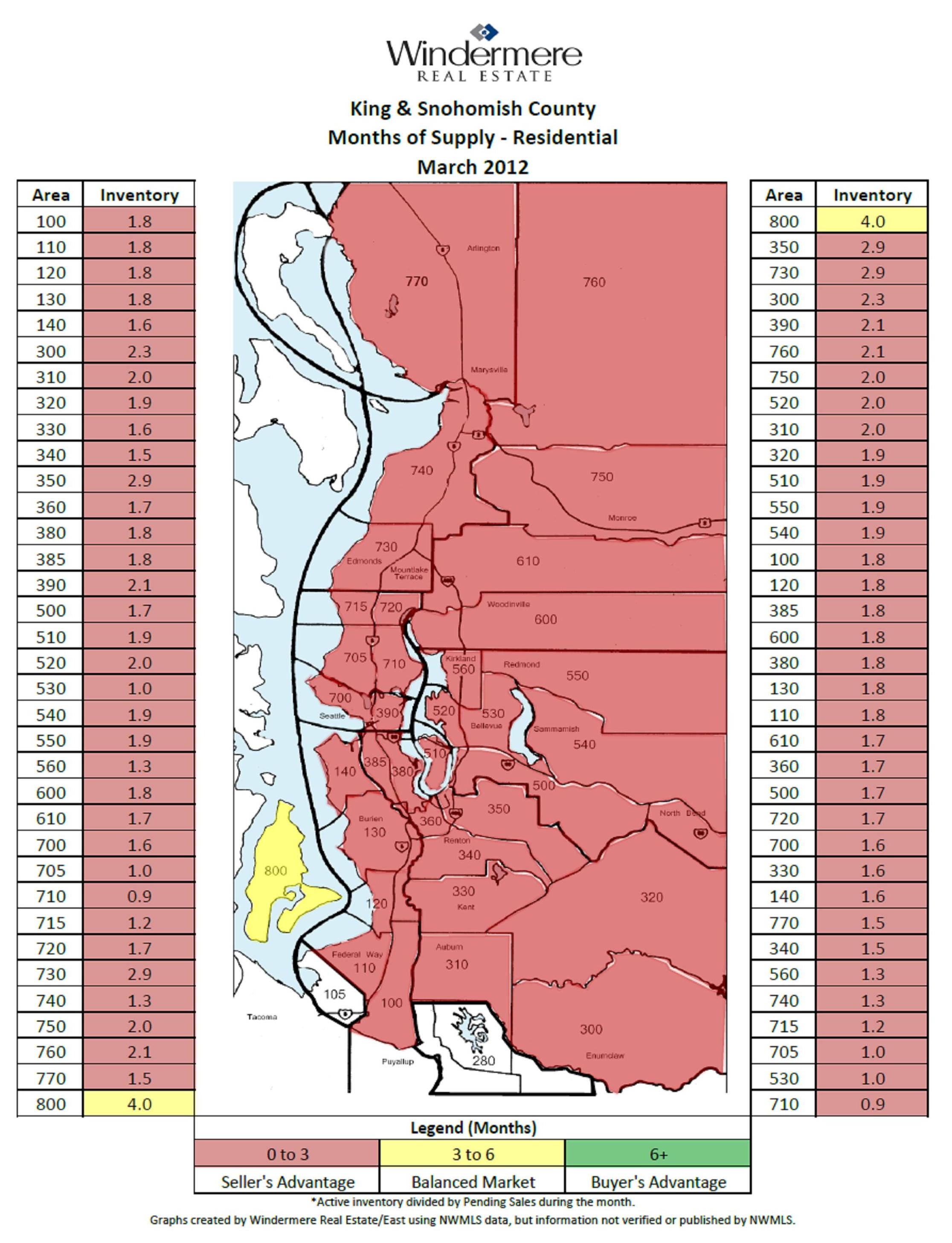

The Real Estate Sales Numbers in Redmond, Kirkland, Bellevue Continue to Be Fabulous

This tells it like it is in the Seattle area real estate market. The entire region, with the exception of Vashon Island in yellow, is a sellers market, which is indicated by the color red. The top sales rate, not the most sales, once again goes to Redmond and East Bellevue near Microsoft. In March, 80% of the homes sold there, while 69% sold in April! The odds of selling a home were the lowest in other parts of Redmond and Carnation. But at 32%, the odds were still good. This is a testament to the positive economy in the Seattle area and on the eastside.

Microsoft is hiring and moving people around the country. We know this first hand as we’re working with three different buyers who are either moving into the Bellevue/Redmond area or moving out of state for Microsoft.

Multiple offers, a shortage of homes, a huge percentage of homes selling in a short amount of time. some price increases (although minimal) are happening all over the Seattle eastside real estate market. The Seattle Times recently published a very positive picture of the local real estate market.

The cities below are reported together to follow our MLS areas (multiple listing service) information.

1. Redmond/East Bellevue

The odds of selling a home were 69%!!!!!

Median sales price decreased from $430,000 to $428,000 (y-o-y)**

97 homes were for sale

A total of 67 homes sold

Days on the market: 70

2. South Bellevue/Issaquah

The odds of selling a home were 48%

Median price increased from $520,000 to $522,000

244 homes were for sale

A total of 118 homes sold

Days on market: 85

3. The plateau: Sammamish, Issaquah, North Bend, and Fall City

The odds of selling a home were 44%

Median sales price increased from $467,000 to $472,000

There were 467 homes for sale

A total of 203 homes sold

Days on the market: 110

4. Woodinville/Bothell/Kenmore/Duvall/North Kirkland

The odds of selling a home were 42%

Median sales price increased from $383,000 to $385,000

397 homes were for sale

A total of 165 homes sold

Days on Market: 103

5. Kirkland

The odds of selling a home were 36%

Median sales price decreased from $550,000 to $430,000

132 homes were for sale

A total of 47 homes sold

Days on Market: 72

6. West Bellevue

The odds of selling a home were 34%.

Median sales price increased from $973,000 to $1,185,000

118 homes were for sale

A total of 40 homes sold

Days on Market: 107

7. Redmond/Education Hill/ Carnation

The odds of selling a home were 32%

Median sales price increased from $452,000 to $538,000!

219 homes were for sale

A total of 69 homes sold

Days on Market: 159

If you’d like more specific information about your neighborhood or home, feel free to contact either Brooks or me.

*(The odds of selling a home in each area is a result of the number of homes for sale divided by the actual number of home sales, so if 10 out of 100 homes sold, the odds of selling would be 10/100 or 10%)

** (y-o-y) median pricing is comparing year over year numbers.

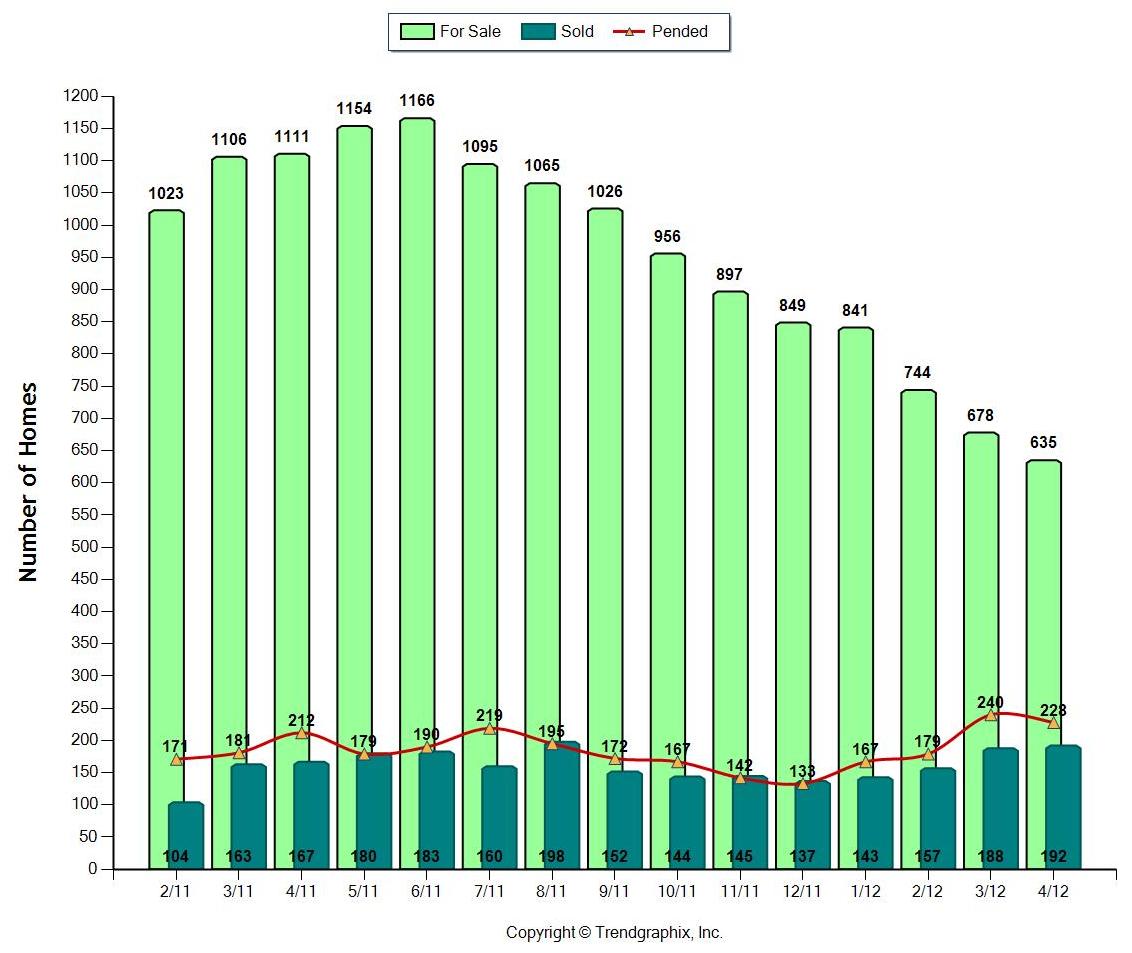

Real Estate Sales in Bellevue, Kirkland, and Redmond, Etc Are Hot!

Red is busting out all over the map of Seattle Real Estate Sales! Red means it’s a sellers market in which homes, on average, are selling in less than 3 months! The numbers are really strong in all of the eastside cities, but top sales go to the 80% sales rate in Redmond and East Bellevue near Microsoft last month! Incredible odds! In every other area on the eastside over 40% of the homes sold.

Closed sales, the sales in which the new buyer now owns the house, are showing lower sales numbers because the homes that closed in March actually got offers in January or February. Expect the number of sales for each of the coming months to jump higher because March home sales will be closing in April and May.. Market time will continue to decrease as this faster sales market continues.

Pricing has still been dropping as you can see below, but should become more stable as the prices from these March sales becomes public. Some areas actually showed an increase in pricing, but remember, it is a representation of the sales that sold in March only.

Multiple offers, a shortage of homes, a huge percentage of homes selling in a short amount of time are all the buzz words for the Seattle eastside real estate market.

The cities below are reported together to follow our MLS areas (multiple listing service) information.

1. Redmond/East Bellevue

The odds of selling a home were 80%

Median sales price decreased from $476,000 to $427,000 (y-o-y)**

95 homes were for sale

A total of 76 homes sold

Days on the market: 135

2. Kirkland

The odds of selling a home were 57%

Median sales price decreased from $570,000 to $469,000

137 homes were for sale

A total of 53 homes sold

Days on Market: 83

3. West Bellevue

The odds of selling a home were 46%.

Median sales price increased from $888,000 to $1,000,000

117 homes were for sale

A total of 54 homes sold

Days on Market: 70

4. The plateau: Sammamish, Issaquah, North Bend, and Fall City

The odds of selling a home were 44%

Median sales price decreased from $505,000 to $462,000

There were 436 homes for sale

A total of 193 homes sold

Days on the market: 127

4. (tie) South Bellevue/Issaquah

The odds of selling a home were 44%

Median price increased from $510,000 to $560,000

225 homes were for sale

A total of 98 homes sold

Days on market: 99

5. Redmond/Education Hill/ Carnation

The odds of selling a home were 43%

Median sales price increased from $411,000 to $472,000

193 homes were for sale

A total of 83 homes sold

Days on Market: 100

6. Woodinville/Bothell/Kenmore/Duvall/North Kirkland

The odds of selling a home were 42%

Median sales price decreased from $423,000 to $369,000

365 homes were for sale

A total of 151 homes sold

Days on Market: 100

If you’d like more specific information about your neighborhood or home, feel free to contact either Brooks or me.

*(The odds of selling a home in each area is a result of the number of homes for sale divided by the actual number of home sales, so if 10 out of 100 homes sold, the odds of selling would be 10/100 or 10%)

** (y-o-y) median pricing is comparing year over year numbers.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link