How Was The Seattle Eastside Condo Market in January 2012?

The Seattle-Eastside condo real estate market in the cities of Bellevue, Kirkland, Redmond, etc was even better in January than December of last year. This is not terribly surprising. When the calendar rolls around to a new year, buyers minds turn to real estate and home buying.

The Seattle-Eastside condo real estate market in the cities of Bellevue, Kirkland, Redmond, etc was even better in January than December of last year. This is not terribly surprising. When the calendar rolls around to a new year, buyers minds turn to real estate and home buying.

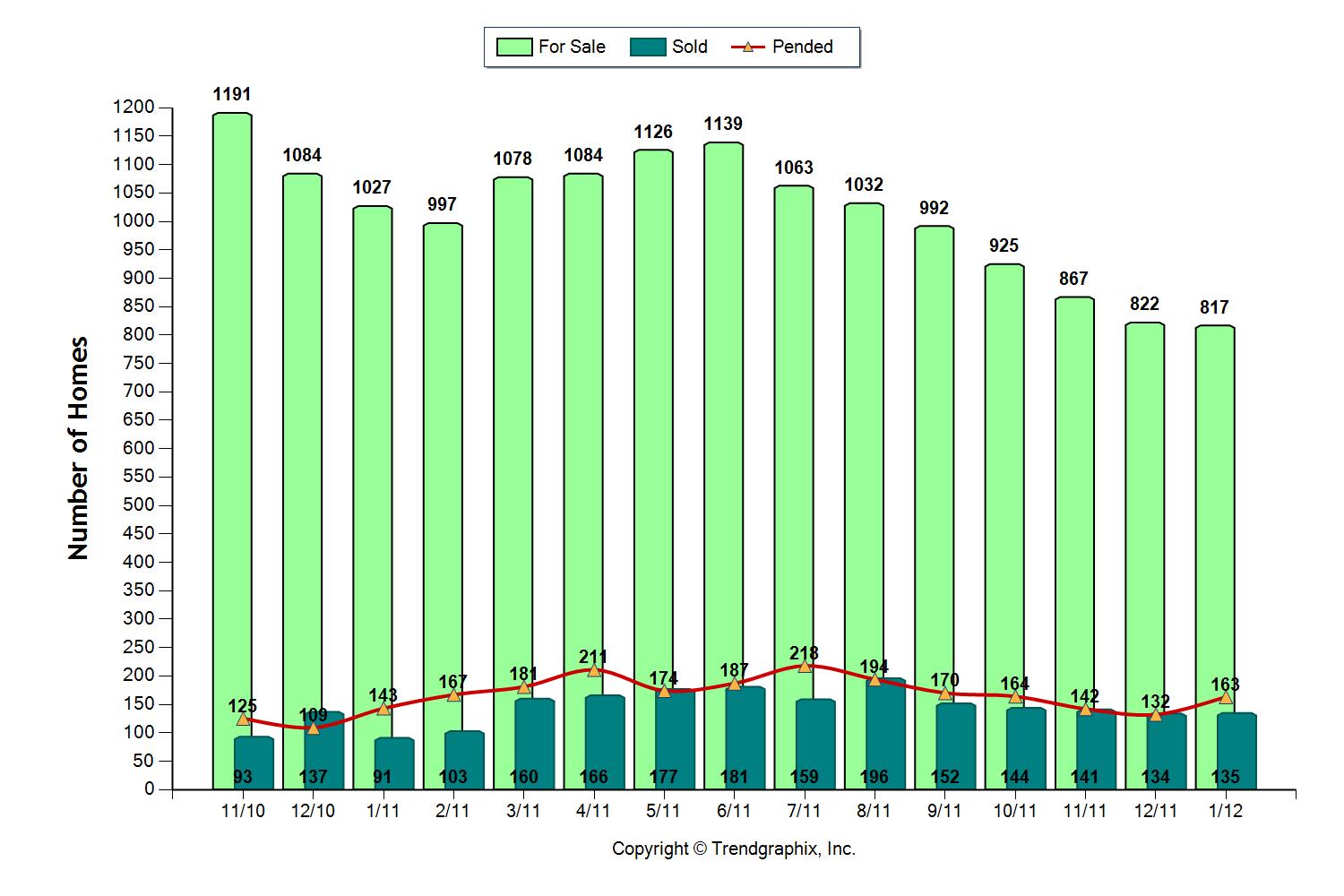

The number of condos for sale on the eastside was almost the same as in December. However, 31 more condos sold in January than in December. Interestingly, there were 247 new listings, but with the number of sales happening and other condos coming off the market, the supply has remained static. The demand has been far greater. The well priced and well maintained condos are selling as fast as they are coming up on the market.

Ironically, 20% fewer condos were on the market in January than a year ago.

As I’ve mentioned before, expect this year’s condo real estate market to be the strongest we’ve had for sales in 5 years. In January, 20% of the available condos sold which is equal to the highest percentage of sales in July of last year. Condos were on the market an average of 133 days and sold within 89% of their original asking price. Surprisingly, the median price dropped from $235,000 last year to $168,000 this year.

I truly think this only represents the fact that the majority of condos that sold in January happened to be less expensive than those that sold last January. I don’t think prices have dropped that much. I look forward to seeing the price point for condo sales when we have February’s statistics available. So don’t give up hope just yet. Prices are down for everyone, whether it’s a house or condo, but it may not be as bad as January’s median pricing suggests.

As we’ve mentioned before, expect this year’s condo real estate market to be the strongest we’ve had for sales in 5 years. The lack of supply should help to spur the market on. Happy condo hunting!

How Was The Real Estate Market In Bellevue, Kirkland, Redmond, and Other Eastside Cities At The Start of 2012?

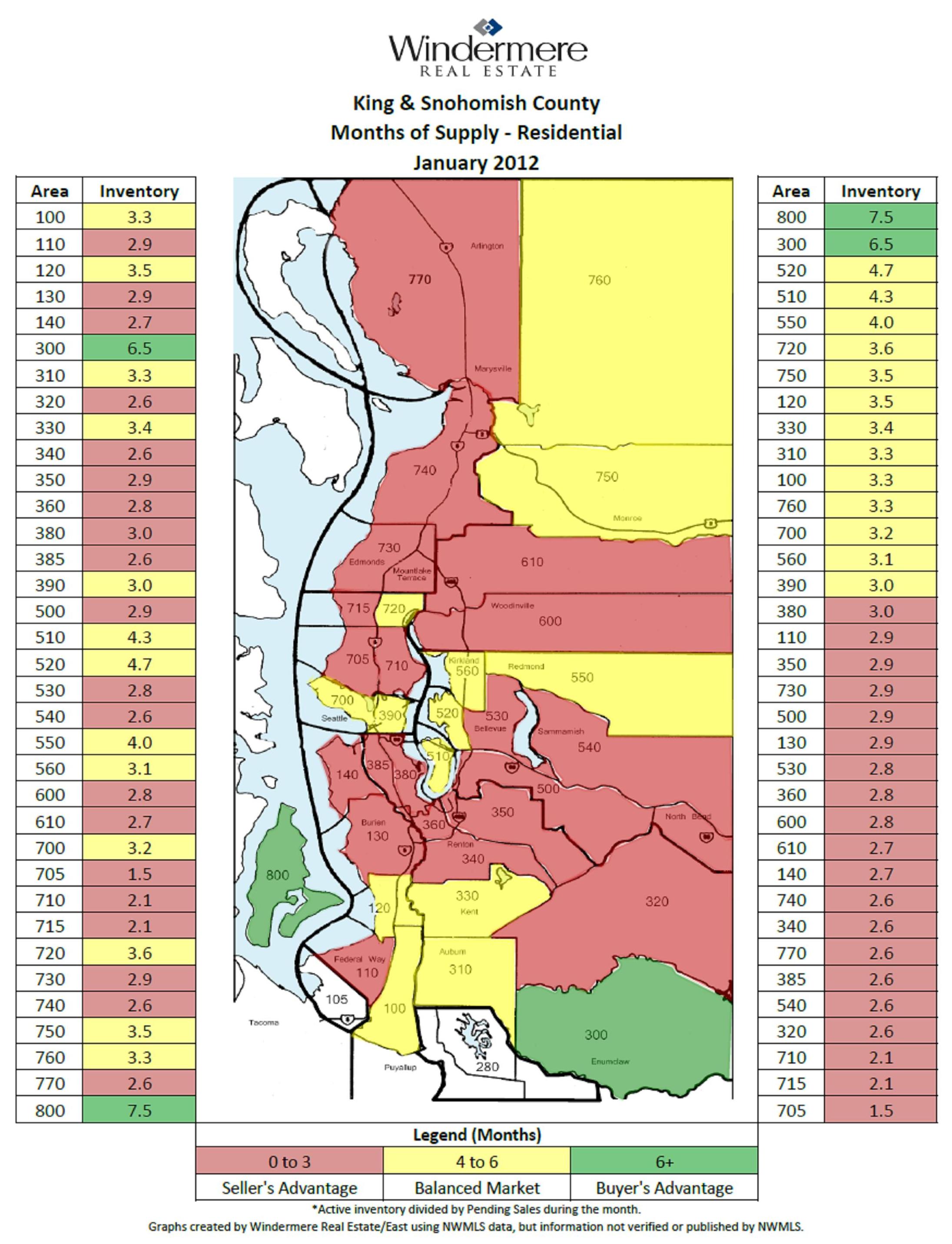

There’s a lot of “red” on the above Seattle area real estate map! There’s more “red” than we’ve seen in years, and I mean years. What does the “red” mean? It means it’s a seller’s market. The homes that are in the “red” areas sell in less than 3 months on average. In January, most of the eastside was a seller’s market. Mercer Island, West Bellevue, and Kirkland did not quite reach the threshold of a seller’s market, but Kirkland was almost there. The real estate markets in these areas were more evenly balanced between the buyers and sellers as homes sold on average within 3-6 months.

This real estate market is pretty exciting to see after the tough markets of the last few years. But what this really means is that we have a more normal market on Seattle’s eastside. The good homes that are priced right and show well are the homes that are selling quickly and bringing the average market time down. There are and still will be homes that aren’t priced well or don’t show well which will sit on the market and take longer to sell.

The chance of a home selling in the different eastside cities ranged from 15-30%. West Bellevue had the fewest sales when compared to the number of available homes, while the plateau cities of Sammamish, North Bend, and Fall City saw almost a third of the homes sell in one month!

But King County is a big place, and the real-estate market isn’t the same in SeaTac as it is in Sammamish.

A closer look at the statistics reveals significant variations from neighborhood to neighborhood.

It’s good to see the Times recognizing the neighborhood differences, since too many times the media publishes data, which covers too broad an area. This does not give an accurate picture of the real estate data.

How was real estate market in your Seattle-Eastside city in January, 2012?

1. The plateau: Sammamish, Issaquah, North Bend, and Fall City

The odds of selling a home were 30%

Median sales price decreased from $496,000 to $465,000 (y-o-y)**

There were 469 homes for sale

A total of 86 homes sold

Days on the market: 123

2. South Bellevue/Issaquah

The odds of selling a home were 28%

Median price decreased from $575,000 to $484,000

226 homes were for sale

A total of 35 homes sold

Days on market: 90

3. Kirkland

The odds of selling a home were 27%

Median sales price decreased from $534,000 to $522,000

155 homes were for sale

A total of 34 homes sold

Days on Market: 62

4. Redmond/East Bellevue

The odds of selling a home were 26%

Median sales price increased from $380,000 to $460,000

125 homes were for sale

A total of 32 homes sold

Days on the market: 94

5. Woodinville/Bothell/Kenmore/Duvall/North Kirkland

The odds of selling a home were 25%

Median sales price decreased from $390,000 to $344,000

387 homes were for sale

A total of 64 homes sold

Days on Market: 115

6. Redmond/Education Hill/ Carnation

The odds of selling a home were 21%

Median sales price decreased from $522,000 to $483,000

193 homes were for sale

A total of 30 homes sold

Days on Market: 112

5. West Bellevue

The odds of selling a home were 15%.

Median sales price increased from $650,000 to $1,230,000

118 homes were for sale

A total of 18 homes sold

Days on Market: 86

If you’d like more specific information about your neighborhood or home, feel free to contact either Brooks or me.

*(The odds of selling a home in each area is a result of the number of homes for sale divided by the actual number of home sales, so if 10 out of 100 homes sold, the odds of selling would be 10/100 or 10%)

** (y-o-y) median pricing is comparing year over year numbers.

And You Wonder Why We Live on Seattle’s Eastside?

My 2009 Predictions for 2012 Seattle Area Real Estate

Predictions for 2012 Seattle-Eastside Real Estate?

I’d just written a post with predictions for this year’s real estate market, when I happened to come across this post from 2 1/2 years ago with positive predictions about the 2012 Bellevue/Eastside real estate market.

Looking at the reprinted post below, how much looks like it could be true for 2012?

Rebound in Seattle/Eastside real estate? Wait until 2012.

A rebound in Seattle real estate? Yes, but not just yet, and it will probably be a small rebound, IMHO. Both Yahoo, via the Plugged in Finance blog and Businessweek had articles projecting a faster return to a more positive real estate market for Seattle than for many other parts of the country. Seattle ended up on the top 10 real estate rebound lists on both Yahoo and Businessweek.

Why a rebound in Seattle? Seattle’s chances are among the best in the country and for the same reasons the Seattle/Eastside area was so strong for most of the last two decades. It’s our economy and our geography.

First, the geography. (Bear with me for this brief geography lesson. This brings me back to my roots as a social studies teacher who loves geography.) There’s a lot of empty space east of Seattle, Bellevue and other parts of King County. This is where the foothills of the Cascade Mountain range begins. It looks like there’s lots of open space out there, and there is, but it gets pretty steep! It’s certainly not conducive to building a home. Couple this with strict land use regulations, protecting salmon streams as an example, and even less land is available for development. It’s double-edged sword. We need to maintain a healthy balance between people and nature, to maintain our wildlife, our trees, and our quality of life. But the natural elements of the Seattle area, Puget Sound, Lake Washington, and the Cascade Mountains do provide a challenge to our growth. Less land to develop=higher prices, but it won’t happen for a few years and increases should still be modest.

The economy in the Seattle area is hurting like the rest of the country. But there’s a strong economic base that will re-emerge as things start to turn around. The old stand-bys, Microsoft, Starbucks, and Boeing are struggling now, but should bounce back.

Another thing to watch is the number of homes for sale, the housing inventory. We’re still at higher numbers, but things are starting to balance out. If you look at the maps, you’ll see the Seattle real estate market of 2009 is far more balanced than the Seattle real estate market of 2008. (A balance market is when the number of homes for sale in an area is less than a 6 months supply. Yellow on the attached maps indicates a balanced market in the area.

Builders are NOT buying land right now. Over the years, builders would have huge amounts of land tied up for future building. This is no longer the case. It can take a couple of years to develop a site and to start building homes. With less land available for building and less land owned by builders and ready to be built out, existing homes will be more in demand in the future.

On yesterday’s “Morning Edition” on NPR Station, KPLU, John Maynard interviewed Richard Hagar about another issue, the influx of new people moving to Washington State, the majority of whom are moving to King County. Some of these people rent and some buy condos and homes. The in-migration of people will only help our real estate and economy over time.

The year 2012 seems like a long way off, but we’re halfway through 2009. It’s around a really long corner and it’s not going to be an easy “walk” to get there.

Now we’re at the end of the first month of 2012, what’s happening with Seattle-Eastside Real Estate? There are differences from what I wrote in 2009 that actually bode well for the Bellevue, Kirkland, Redmond, Sammamish, etc areas:

Builders are buying land now. We have a client who was approached by no less than 4 builders last year when his property was not even listed for sale. Within the same week, he received several builder solicitations. He’s not the only homeowner with land who has been approached. Builders are actually looking to beef up their inventory of land so they can build again.

The number of homes on the market has reached the lowest level since February, 2007. In all of King County there are approximately 7500 homes and condos for sale.

The geography hasn’t changed and I believe it will take millions of years before it does and the economy is still performing at a far better pace in the Seattle area than in other parts of the country. Amazon, Microsoft, and other companies are hiring.

What does your crystal ball say?

Predictions for 2012 Real Estate on the Eastside-Bellevue, Redmond, Kirkland, Etc.

With the start of the new year, we’re seeing a more positive attitude out in the marketplace. It’s amazing what a new year can bring in attitude and outlook for people. Many are making choices to move because they want or need to do so. For some, the price issue is taking a back seat to the need to move. We have several clients who plan to move because they just got married and want a new home or would like to live in the city, downsize or relocate. These moves are lifestyle choices. Some will lose money, while others will make a profit on their home sale. Lifestyle wants and needs trump the monetary outcome for some. Truthfully, if homeowners can make a choice as to whether to sell or hold, they are the fortunate ones.

What’s on the horizon for 2012? As I was driving to a meeting recently, I heard a piece on KPLU about the expected improvement in the Puget Sound economy.

Dick Conway, an economic forecaster. had spoken at the 40th Anniversary Economic Forecast Conference in Seattle. Here are five reasons Conway thinks the future is bright:

- Boeing is showing strong employment, with the 737 MAX and the 787 being built here, the labor peace pact, and strong bonuses. Overall, it is a very nice scenario for the Puget Sound Economy.

- Job growth in the region is generally outpacing the nation. The strength of both Boeing and Microsoft causes a “multiplier effect,” bringing more jobs with them.

- Retail sales numbers have been a pleasant surprise. Conway predicts a 5.9 percent increase in 2012 and a bit more than 3 percent growth in 2013.

- Foreign exports are leading the recovery and Washington state is the nation’s top exporter, thanks again to Boeing. (Microsoft is also a factor here.)

- The Puget Sound is home to many strong local companies.

Matthew Gardner had a fairly optimistic view for 2012 real estate in the Seattle area:

When combined with improving economic conditions, I would not be surprised to see several markets exhibit modest price growth in 2012. That said and, as we all know, real estate is all about location; therefore I do not expect that price recovery will be equal across all markets.

He tempers this line of thinking with the two elephants in the room: the expected supply of distressed sales that will hit the market and the difficulty of obtaining financing:

If this is actually the case, then why aren’t prices higher? Well, there are still a number of anchors that are holding us back. The first of which is the shadow inventory in the shape of distressed homes. Many foreclosures have been trading at below market value and, in some cases, below replacement cost. This naturally holds down values.

Secondly, and equally as important, are the continued issues with obtaining financing for the purchase of a new home. It remains remarkably difficult to get a mortgage, which has led to an unusually high percentage of proposed purchases falling through.

With the new year and promising economic news, we expect Seattle-eastside real estate to be the strongest since 2007. Home sales should be steady even as inventory rises into the summer. Prices, of course, may stay about where they are for now. The key to pricing will be the supply of homes on the market. The more homes, the more competition for buyers and the more flexible sellers will need to be about pricing. With fewer homes on the market and steady demand, prices should stabilize. If prices do go up, most likely it will be in the areas that are close-in, areas which are considered desirable locations. Expect distressed sales to temper the pricing this year. The number of homes for sale and pricing will vary from neighborhood to neighborhood. The eastside is filled with real estate micro-markets and they don’t perform in the same way.

If there are any price increases, they will be minimal, but if there are increases, we will be shouting this from the rooftops! Because we watch market trends so carefully, our sellers will be among the first to know about any price increases. You will, however, hear us shouting that 2012 is expected to be our best market in the last 4 years.

Our predictions:

- Prices should not drop further.

- Some homes will be the “hot” ones because of price and condition. These homes will sell quickly and some will have multiple offers.

- Other homes and neighborhoods will move more slowly because of price and location.

- Local companies, such as Amazon and Microsoft, will continue to move people to the area.

- The supply of homes for sale will increase as the year heads to spring and summer, however, there are some homeowners who will choose to hold for a number of years. The supply should not increase as dramatically as it has in the last few years.

- Distressed sales will continue to be a significant part of the supply and will continue to affect pricing statistics. However, pricing will be stronger for those homes that aren’t distressed sales.

- There will be a more balanced market between buyers and sellers.

- The wide range of activity indicates a normal, active real estate market on Seattle’s eastside.

What do you think will happen real estate in cities such as Bellevue, Kirkland, and Redmond? Will prices go up, down or stay the same? Do you see a good market in your area?

How Was The Seattle Eastside Condo Market in December 2011?

Seattle Eastside condo inventory dipped to 2011’s lowest point in December, 2011.

The year began and ended with under 1000 condos for sale.

The number of available eastside condos peaked in June with well over 1100 condos for sale. The peak was never really much of a peak when we look at the peak numbers in previous years. In the past, the number of condos could easily top out at 1500 for sale. In October 2010, there were 1375 condos for sale, and that was not even the peak month for 2010.

As most people know, condos have been hit harder than single family homes by the economic downturn. Prices are down quite a bit, so it’s good to see 2011 end with fewer condos for sale on the eastside. There’s a big drop in value for condos, about 18% for the year, but the reality is the lower prices are helping to move some of the supply.

With fewer condos for sale and a fresh start with the new year, I expect to see condos sell well. The economy is doing better locally with Boeing, Amazon, Microsoft, and others in a hiring mode. Prices will continue to stay low, but with the huge decline in the number of properties for sale, prices should remain stable this year.

There were 822 condos for sale in December, with 138 of them receiving offers. The average market time was 135 days, a shorter market time than last December’s 156 days. Condos sold within 90% of the original asking price.

Median pricing is down overall, but the median sales price increased during December by 7% from $224,000 in December, 2010 to $239,000. Remember median pricing reflects what sold that particular month. This doesn’t mean pricing was up 7% for the year, but what sold in December, 2011 was slightly more expensive than what sold in December, 2010.

Our condo supply is usually the highest in the summer. The bell curve shape for the number of condos for sale on the above chart is the typical pattern for most years, regardless of how the real estate market performs. Condos do sell well in the summer, but competition is much fiercer. If you’re thinking of selling your eastside condo, it’s best to get on the market in the early spring to get ahead of the competition.

Since we have micro-real estate markets in Bellevue, Redmond, Kirkland and the other eastside cities, please contact us if you have questions about your complex or your condo’s value.

Have a great 2012!

How Was The Real Estate Market In Your Seattle-Eastside City in December 2011?

The cities below are grouped together to follow our MLS areas (multiple listing service). This is how our statistics are reported.

How was real estate market in your Seattle-Eastside city in December, 2011?

1. Redmond/East Bellevue

The odds of selling a home were 36%*

Median sales price increased (y-o-y)**from $420,000 to $455,000

125 homes were for sale

A total of 42 homes sold

Days on the market: 104

2. Kirkland

The odds of selling a home were 19%

Median sales price increased from $498,000 to $510,000

167 homes were for sale

A total of 57 homes sold

Days on Market: 101

2. (TIE) South Bellevue/Issaquah

The odds of selling a home were 19%

Median price decreased from $560,000 to $505,000

242 homes were for sale

A total of 58 homes sold

Days on market: 123

3. The plateau: Sammamish, Issaquah, North Bend, and Fall City

The odds of selling a home were 17%

Median sales price increased from $440,000 to $463,000

There were 527 homes for sale

A total of 116 homes sold

Days on the market: 103

4. Redmond/Education Hill/ Carnation

The odds of selling a home were 16%

Median sales price decreased from $530,000 to $515,000

207 homes were for sale

A total of 66 homes sold

Days on Market: 115

4. (TIE) Woodinville/Bothell/Kenmore/Duvall/North Kirkland

The odds of selling a home were 16%

Median sales price decreased from $393,000 to $339,000

421 homes were for sale

A total of 96 homes sold

Days on Market: 127

5. West Bellevue

The odds of selling a home were 10%.

Median sales price increased from $950,000 to $998,000

127 homes were for sale

A total of 15 homes sold

Days on Market: 95

If you’d like more specific information about your neighborhood or home, feel free to contact either Brooks or me.

*(The odds of selling a home in each area is a result of the number of homes for sale divided by the actual number of home sales, so if 10 out of 100 homes sold, the odds of selling would be 10/100 or 10%)

** (y-o-y) median pricing is comparing year over year numbers.

How Was The Real Estate Market in your Seattle-Eastside City in November 2011?

If you lived in Kirkland and had your home for sale last month, the odds of it selling in November were 31%, the strongest absorption rate to be found on the eastside.* The homes in East Bellevue and Redmond areas around Microsoft had a 29% chance of selling. Chances of selling ranged from 11-22.5% in the other eastside cities.

Homes in East Bellevue and Redmond near Microsoft sold the fastest on Seattle’s eastside. On average, homes there sold in 2 months. Market time for the other eastside cities, ranged from 3 to 4 months.

This is reasonable market time, indicating a balanced market between buyers and sellers. A balanced market means there’s a more normal market. Some homes sold quickly and others stayed on the market for a long time. Some homes sold for full price and others sold at steep discounts.

The cities below are grouped together to follow our MLS areas (multiple listing service). This is how our statistics are reported.

How was real estate market in your Seattle-eastside city in November, 2011?

1. Kirkland

The odds of selling a home were 31%.*

Median price decreased (y-o-y)** from $530,000 to $477,000.

188 homes were for sale.

A total of 58 homes sold.

Days on Market: 105

2. Redmond/East Bellevue

The odds of selling a home were 29%.

Median sales price decreased to $418,000 from $527,000.

163 homes were for sale

A total of 48 homes sold.

Days on the market: 60

3. South Bellevue/Issaquah

The odds of selling a home were 22.5%.

Median price increased from $538,000 to $550,000.

267 homes were for sale.

A total of 60 homes sold.

Days on market: 98

4. Redmond/Education Hill/ Carnation

The odds of selling a home were 22%

Median pricing decreased from $540,000 to $530,000.

247 homes were for sale.

A total of 54 homes sold.

Days on Market: 104

4. (tie) Woodinville/Bothell/Kenmore/Duvall/North Kirkland

The odds of selling a home were 22%.

Median price was down from $451,000 to $394,000.

481 homes were for sale.

A total of 105 homes sold.

Days on Market: 114

5. The plateau: Sammamish, Issaquah, North Bend, and Fall City

The odds of selling a home were 18%.

Median sales price decreased from $460,000 to $441,000.

There were 580 homes for sale.

A total of 104 homes sold.

Days on the market: 119

6. West Bellevue

The odds of selling a home were 11%.

Median pricing decreased to $950,000 from $1,035,000.

127 homes were for sale.

A total of 14 homes sold.

Days on Market: 91

If you’d like more specific information about your neighborhood or home, feel free to contact either Brooks or me.

*(The odds of selling a home in each area is a result of the number of homes for sale divided by the actual number of home sales, so if 10 out of 100 homes sold, the odds of selling would be 10/100 or 10%)

** (y-o-y) median pricing is comparing year over year numbers.

Which Eastside City had the Fastest Selling Homes In October, 2011?

Homes in East Bellevue and Redmond near Microsoft sold the fastest on Seattle’s eastside in October. Homes sold in under 2 months, at 59 days. Market time for the other eastside cities, ranged from 99-117 days or just shy of 4 months. This is a reasonable market time as it shows a more of a balanced market between buyers and sellers. It’s actually a normal market and is better for “both sides of the table.”

The odds of selling a home in the Redmond and East Bellevue areas stood at 30%, which also was the strongest absorption rate to be found on the eastside.* Chances of selling ranged from 19-26% in the other eastside cities.

The Redmond and East Bellevue area near Microsoft comes out on top for market time and a higher absorption rate because of more affordable housing, good jobs, an easier commute and good schools. With the main Microsoft campus in Redmond right on the Bellevue line, there are lots of jobs right there. In addition, there’s easier freeway and bus access to Seattle than in the outlying suburbs.

The higher price point in West Bellevue means fewer buyers can afford to live there. Affordability issues increase the market time. Longer market time here is a function of pricing, not desirability. West Bellevue is considered to be one of the best locations on the eastside.

Two of the areas had an increase in the median pricing, Redmond and East Bellevue and Redmond and Education Hill. Changes in median pricing, however, need to be looked at over a period of months since the median price for this month reflects the sales for this month only.

Why is market time important? It’s one indication of the desirability and affordability of an area. Both are key to future growth and appreciation. People like to live in convenient areas with good schools and affordable housing.

The cities below are grouped together to follow our MLS areas (multiple listing service) and shows how our statistical information is reported. How did your city do this past month?

Which Seattle-eastside city had the fastest selling homes in October, 2011?

1. Redmond/East Bellevue

The odds of selling a home were 30%.*

Median sales price increased (y-o-y)** to $435,000 from $427,000.

193 homes were for sale

A total of 58 homes sold.

Days on the market: 56

2. Kirkland

The odds of selling a home were 26%.

Median price decreased from $592,000 to $501,000.

234 homes were for sale.

A total of 60 homes sold.

Days on Market: 99

3. Redmond/Education Hill/ Carnation

The odds of selling a home were 19%

Median pricing increased from $541,000 to $580,000.

321 homes were for sale.

A total of 62 homes sold.

Days on Market: 100

4.Woodinville/Bothell/Kenmore/Duvall/North Kirkland

The odds of selling a home were 22%.

Median price was down from $377,000 to $370,000.

540 homes were for sale.

A total of 117 homes sold.

Days on Market: 101

5. South Bellevue/Issaquah

The odds of selling a home were 24%.

Median price decreased from $580,000 to $500,000.

338 homes were for sale.

A total of 81 homes sold.

Days on market: 104

6. The plateau: Sammamish, Issaquah, North Bend, and Fall City

The odds of selling a home were 23%.

Median sales price decreased from $500,000 to $460,000.

There were 650 homes for sale.

A total of 158 homes sold.

Days on the market: 108

7. West Bellevue

The odds of selling a home were 22.5%.

Median pricing decreased from $985,000 to $878,000.

128 homes were for sale.

A total of 31 homes sold.

Days on Market: 117

If you’d like more specific information about your neighborhood or home, feel free to contact either Brooks or me.

*(The odds of selling a home in each area is a result of the number of homes for sale divided by the actual number of home sales, so if 10 out of 100 homes sold, the odds of selling would be 10/100 or 10%)

** (y-o-y) median pricing is comparing year over year numbers.

Was There Really a Decline In Seattle Eastside Real Estate Pricing in October, 2011?

Yes, Virginia, there was a decline in median pricing on Seattle’s eastside in October. The Seattle media got everyone a little nervous about real estate when it stated there had been a 15% y-o-y price drop in King County real estate prices from October of 2010 to 2011. I talked with several clients who were speaking doom and gloom about the eastside real estate market based on the news stories. I suggested they look at the true numbers for the eastside, not the entire county. The article discussed all of King County, which includes areas that are not doing as well as the eastside. Seattle and the eastside cities, such as Bellevue, Kirkland, and Redmond, are the shining stars of King County real estate. If you look near the bottom of the article, it states the decline in eastside real estate prices measured in the single digits, not 15%.

The decline on the eastside depends on what you were looking at when comparing the numbers. Median sales pricing declined by 9% from last year, but the average sold prices increased from $602.000 to $619,000. It’s more of a mixed bag, although no home owner likes to see any sort of a decline.

Why the decline in median sales pricing? Here are some possible reasons:

- Jumbo loan rates have gone up, limiting the number of buyers who can buy at the higher end of the market.

- Distressed sales take up a large portion of the home sales all over the county. Distressed sales, short sales and foreclosures, usually sell for less than market value, thus causing the median pricing to drop.

- Lastly, the numbers you see here are a result of the real estate sales activity that happened that particular month only. In order to see a trend, it is important to look at a number of months together. One month is only indicative of that particular month’s sales.

Remember real estate is hyperlocal and North King and South King County are different real estate markets than Seattle’s eastside. In one of my next posts, I’ll look at the eastside real estate market even more closely and show the hottest and coolest selling areas.

Now that we have that issue of the decline in median pricing examined more closely, let’s take a look at what happened with eastside real estate in October. There were 24% fewer homes on the market this October than last and 22% more homes sold than in 2010. There were also 8% fewer homes on the market than in September of this year. Sales increased by 22% from last year and by 11% from September of this year.

Most home sold within 97 days and for about 92% of the original asking price. Sellers had a 23% chance of getting their homes sold last month. These are strong numbers, much stronger than October of 2010.

I’ll be watching the sales trend over the next couple of months. I expect to see fewer homes on the market and fewer sales as we approach the holidays. But will median pricing decline? What do you think?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link